Questions? Contact admin@cashconfident.com

Thrive Beyond Six Figures

without the hustle

YES?

Keep reading.

Are you tired of the old model of success, where you work hard, hustle, sacrifice and save for financial success… only the wealth never actually materializes for you?

Are you ready to create a full life of abundance, with fat stacks of cash, time to smell the roses, raise your kids and concert tickets to your favorite sexy cellist in an exotic foreign city?

As a freakin’ POWERHOUSE, you deserve to be well-paid, served peeled fruits in the sunshine while you come up with brilliant ideas and live a juicy, fulfilling life.

Thrive Beyond Six Figures

without the hustle

Are you tired of the old model of success, where you work hard, hustle, sacrifice and save for financial success… only the wealth never actually materializes for you?

Are you ready to create a full life of abundance, with fat stacks of cash, time to smell the roses, raise your kids and concert tickets to your favorite sexy cellist in an exotic foreign city?

As a freakin’ POWERHOUSE, you deserve to be well-paid, served peeled fruits in the sunshine while you come up with brilliant ideas and live a juicy, fulfilling life.

When You LOOK like Success but FEEL like Struggle

When You LOOK like Success but FEEL like Struggle

when finding a penny on the ground and are still frustrated and feeling not good enough.

You know this problem is deeper than most money mindset advice goes, and can see yourself stuck in generations old patterns. You’ve done enough manifestation work to know your dream is possible for you, but you can’t see how to get out of your own way.

When you push and grind too long for too little, it is so defeating. Some badass women give up, feeling discouraged in their quest for financial independence and settle for less. Others go on a quest of self-improvement spending tens of thousands thousands of dollars on coaching, courses and hallucinogenic teas that have no financial ROI.

I'm Here To Tell You That Many Trailblazing Women Struggle To Master Money And It Isn't Due To A Lack Of Ambition, Capability Or Intelligence.

It's because they've never been taught about Wealth Identity.

Wealth Identity is a mindset blueprint that guides you in defining who you want to be and the kind of life you want to live.

However, this blueprint is based on men's experiences and successes (and an unspoken assumption that a woman is at home taking care of the household 🙄).

While women can follow these models and achieve some success, you'll get trapped in old, unrealistic frameworks that don't fit your values and lifestyle.

The old Wealth Identity doesn’t work at scale for women.

Women must create their own blueprint for financial success and happiness.

There is a way to align your actions with your true Wealth Identity and achieve the financial independence you deserve.

A well crafted wealth identity is the magic wand of the powerhouse woman.

A Wealth Identity in alignment with your nerdy little heart's desires and who you’ve decided to BECOME, is MAGIC.

Things start to move with ease because you are not fighting with your own subconscious mind.

Your actions gain momentum and opportunities and cash piles up.

Your work gets easier with the congruence.

Your mind opens up to all sorts of new possibilities.

You start to make money in easier ways providing a new model of success for your family and friends.

You create a legacy for the future with both Scrooge McDuck swimming pools of money and by BEING an example of how women can have success at scale.

It's because they've never been taught about Wealth Identity.

Wealth Identity is a mindset blueprint that guides you in defining who you want to be and the kind of life you want to live.

However, this blueprint is based on men's experiences and successes (and an unspoken assumption that a woman is at home taking care of the household 🙄).

While women can follow these models and achieve some success, you'll get trapped in old, unrealistic frameworks that don't fit your values and lifestyle.

The old Wealth Identity doesn’t work at scale for women.

Women must create their own blueprint for financial success and happiness.

There is a way to align your actions with your true Wealth Identity and achieve the financial independence you deserve.

A well crafted wealth identity is the magic wand of the powerhouse woman.

A Wealth Identity in alignment with your nerdy little heart's desires and who you’ve decided to BECOME, is MAGIC.

Things start to move with ease because you are not fighting with your own subconscious mind.

Your actions gain momentum and opportunities and cash piles up.

Your work gets easier with the congruence.

Your mind opens up to all sorts of new possibilities.

You start to make money in easier ways providing a new model of success for your family and friends.

You create a legacy for the future with both Scrooge McDuck swimming pools of money and by BEING an example of how women can have success at scale.

the Path to Big Fat Stacks

the Path to Big Fat Stacks

Most of the money mindset work out there is based on Think and Grow Rich by Napoleon Hill, the OG of the manifestation game. The problem with that is he only studied men in the 1920s. The Wealth Identity of the 1920s man does not apply to today's women.

Other money mindset work falls a little flat once a considerable amount of success is realized because it’s focused on money and not the person you need to become to command massive cash flow.

Scrimping, saving and pinching pennies in order to get rich almost never works because you can’t get rich by getting better at being poor.

Powerhouse ladies are giving up and burning out because they are following a Wealth Identity meant for a man in the 1920’s, only doing the first part of a money journey and using money management techniques incongruent with wealth.

Hey, Friend! I'm Brie Sodano

My clients call me the Queen Maker. I started helping women pursue wealth in 2013. Since then I have worked with thousands of women to manage their money, grow their incomes and wealth and create full life abundance the woman's way.

After thousands of coaching hours, I have developed methods, processes and techniques to shift the deepest levels of the mind, and create f*tons of money with ease.

Hey, Friend! I'm Brie Sodano

My clients call me the Queen Maker. I started helping women pursue wealth in 2013. Since then I have worked with thousands of women to manage their money, grow their incomes and wealth and create full life abundance the woman's way.

After thousands of coaching hours, I have developed methods, processes and techniques to shift the deepest levels of the mind, and create f*tons of money with ease.

INTRODUCING...

for the powerhouses, trailblazers and breadwinners who want financial freedom and security without the hustle and grind.

I’ve worked with thousands of women to create wealth and there are certain things that basically guarantee financial progress, FAST.

-

Goals are based on true desires. Our nerdy little hearts know the truth of what we want and when our mind takes the desires of the heart into consideration, we can build plans with heart, which creates enthusiasm and magnetism.

-

A well-crafted Wealth Identity with a matching Money Mindset. This means thinking about who you are going to BE, and how you will show up in all facets of life as a well resourced wealthy woman. Then adding all the supporting beliefs to match your fresh new Wealth Identity.

-

The ability to change the subconscious mind. This is the most powerful (and lucrative) skill for consistent growth and evolution. Most of our wealth identity and money mindset lives beneath the surface of the mind in the subconscious and the ability to meet our subconscious and shift it is the most lucrative skill set one can possess.

- Get a raise or massive jump in revenue.

-

Payoff debts while breaking the habits and mindsets at the root.

-

Stack your cash for emergencies, and big opportunities.

- Let go of the money struggle once and for all, breaking generational curses.

-

Feel cool calm and collected with your cash while it comes ion and goes out.

-

Systemize your cash flow like boss.

INTRODUCING...

for the powerhouses, trailblazers and breadwinners who want financial freedom and security without the hustle and grind.

I’ve worked with thousands of women to create wealth and there are certain things that basically guarantee financial progress, FAST.

-

Goals are based on true desires. Our nerdy little hearts know the truth of what we want and when our mind takes the desires of the heart into consideration, we can build plans with heart, which creates enthusiasm and magnetism.

-

A well-crafted Wealth Identity with a matching Money Mindset. This means thinking about who you are going to BE, and how you will show up in all facets of life as a well resourced wealthy woman. Then adding all the supporting beliefs to match your fresh new Wealth Identity.

-

The ability to change the subconscious mind. This is the most powerful (and lucrative) skill for consistent growth and evolution. Most of our wealth identity and money mindset lives beneath the surface of the mind in the subconscious and the ability to meet our subconscious and shift it is the most lucrative skill set one can possess.

Cash Confident™ is the exact thing you need to create a legacy of wealth and well being. In just 12 months you could...

- Get a raise or massive jump in revenue.

-

Payoff debts while breaking the habits and mindsets at the root.

-

Stack your cash for emergencies, and big opportunities.

- Let go of the money struggle once and for all, breaking generational curses.

-

Feel cool calm and collected with your cash while it comes ion and goes out.

-

Systemize your cash flow like boss.

Cash Confident™ is designed exclusively for Baddies like you who are ready to ditch outdated wealth paradigms and create f*tons of money, but while having fun and eating little cakes.

Crafting Your Wealth Identity

We help you develop a well-crafted wealth identity based on your unique values and the living legacy you want to create. This is not a one-size-fits-all approach but a personalized strategy that aligns with who you are and what you stand for.

Lube It Up

Ok, that sounds dirty but alignment is like lubrication for life. When your desires, goals, identity, mindset, actions, and money management match the friction goes away, and you can enjoy the ride.

Wire Your Mind For Wealth

Learning how to work with your subconscious is the key, the most important part to creating wealth and whatever else you want. In Cash Confident, you get processes and techniques to work with your own mind. These skills will save you decades of trouble and thousands on fancy ass coaches.

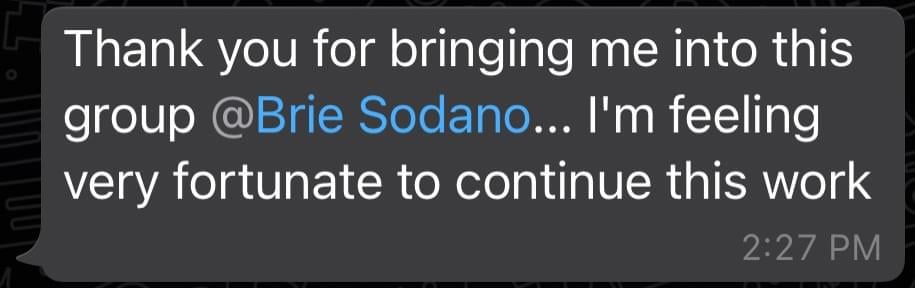

Slumber Party Vibes

You need friends to cheer you on. In the Cash Confident Community we got you. A group of ladies loving on and supporting one another is the sauce.

Cash Confident™ is designed exclusively for Baddies like you who are ready to ditch outdated wealth paradigms and create f*tons of money, but while having fun and eating little cakes.

Crafting Your Wealth Identity

We help you develop a well-crafted wealth identity based on your unique values and the living legacy you want to create. This is not a one-size-fits-all approach but a personalized strategy that aligns with who you are and what you stand for.

Lube It Up

Ok, that sounds dirty but alignment is like lubrication for life. When your desires, goals, identity, mindset, actions, and money management match the friction goes away, and you can enjoy the ride.

Wire Your Mind For Wealth

Learning how to work with your subconscious is the key, the most important part to creating wealth and whatever else you want. In Cash Confident, you get processes and techniques to work with your own mind. These skills will save you decades of trouble and thousands on fancy ass coaches.

Slumber Party Vibes

You need friends to cheer you on. In the Cash Confident Community we got you. A group of ladies loving on and supporting one another is the sauce.

Cash Confident™ is a Slip & Slide into the pool of Scrooge McDuck Money

As a member of Cash Confident, you’ll experience:

Lightning fast financial progress that will last a lifetime.

A solid relationship with money that feels steady and dependable.

A brigade of Baddies that celebrates your success.

Flourishing is super fun.

Join Cash Confident today and learn to use the power of your mind to attract money into every nook and cranny of your life. It’s time to toss away the old paradigms of success and create wealth like a woman.

Cash Confident™ is a Slip & Slide into the pool of Scrooge McDuck Money

As a member of Cash Confident, you’ll experience:

Lightning fast financial progress that will last a lifetime.

A solid relationship with money that feels steady and dependable.

A brigade of Baddies that celebrates your success.

Flourishing is super fun.

Features and Benefits of Cash Confident:

Value: $1000

🚀 Unlock Your Inner Wealth Diva! 🚀

Ever wonder why your bank account doesn’t match your brilliance? Dive deep into the Money Multiplier Foundations Training and uncover your true Wealth Identity. This isn’t just another boring lecture—it's a total mindset makeover! You’ll get a crystal-clear diagnosis of what's holding you back and a roadmap to your dream life. Say goodbye to decades of mindset drama and hello to your fabulous future self!

Value: $2400

(but feeling like a badass is priceless).

💡 Brain Bootcamp: Big Fat Stacks Edition 💡

Forget basic mindset work—this is next-level mental gymnastics! Every month, get a fresh Mental Reprogramming Method and workbook, designed to align your mindset with your Wealth Identity. It’s like a personal trainer for your brain, helping you kick procrastination to the curb and slay those self-sabotage dragons.

Value: $1000

📝 Journal Like a Boss 📝

Who knew journaling could be so powerful? Join our monthly guided sessions and harness the magic of group accountability. These aren’t your grandma’s diary entries—these are high-octane, wealth-building power pages. Get ready to make serious strides in your journey while bonding with your new wealth squad.

Value: $3000

(but who can put a price on becoming a money maestro?)

💡 Brain Bootcamp: Big Fat Stacks Edition 💡

Value: $1000

(inner peace and piles of cash—what more could you want?)

🧘♀️ Zen and the Art of Wealth 🧘♀️

Meditation isn’t just for yogis. Each month, receive a new Money Multiplier Meditation to help you embody your Wealth Identity. These audio gems will move stuck emotions, visualize success, and connect you with your inner money maven.

Value: Priceless

(because true baddie friendships are forever).

🌟 Join the Wealthy Baddie Brigade 🌟

Imagine a community of powerful women all on the same mission: to build wealth and support each other. This isn’t just networking—it’s a full-on wealth-building slumber party (minus the pillow fights). Share wins, ask questions, and bask in the glow of mutual success.

Value: $997

(but the stress-free financial life is worth every penny).

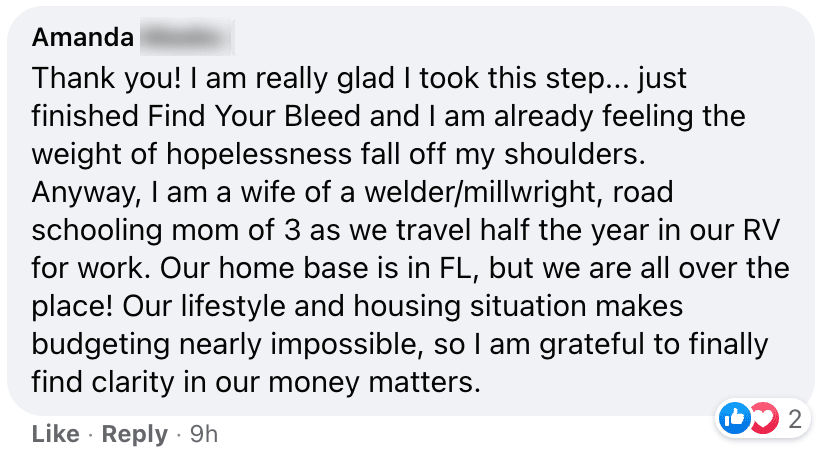

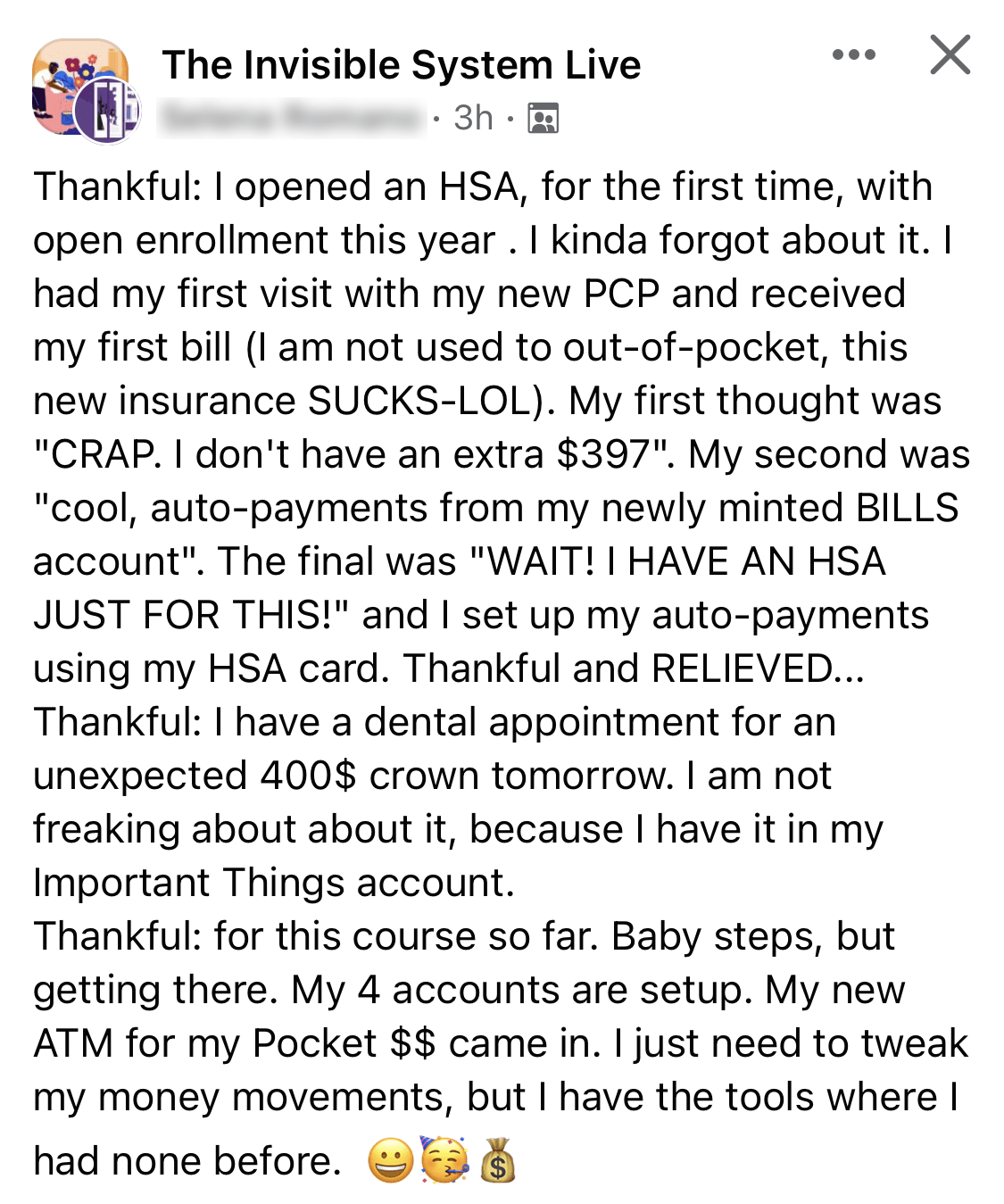

💰 Money Management Made Sexy 💰

Get instant access to a treasure trove of courses teaching you how to manage your money like a pro. Learn to spend intentionally, systemize your finances, and pay off debt—all in just 15 minutes a month.

Value: $260

(because who doesn’t love a good ritual?)

🌙 Rituals for Riches 🌙

Join our live monthly Money Rituals to keep your finances on track. From tracking your cash to paying down debts, these sessions are your monthly money mojo boost.

Features and Benefits of Cash Confident:

Value: $1000

🚀 Unlock Your Inner Wealth Diva! 🚀

Ever wonder why your bank account doesn’t match your brilliance? Dive deep into the Money Multiplier Foundations Training and uncover your true Wealth Identity. This isn’t just another boring lecture—it's a total mindset makeover! You’ll get a crystal-clear diagnosis of what's holding you back and a roadmap to your dream life. Say goodbye to decades of mindset drama and hello to your fabulous future self!

💡 Brain Bootcamp: Big Fat Stacks Edition 💡

Forget basic mindset work—this is next-level mental gymnastics! Every month, get a fresh Mental Reprogramming Method and workbook, designed to align your mindset with your Wealth Identity. It’s like a personal trainer for your brain, helping you kick procrastination to the curb and slay those self-sabotage dragons.

Value: $2400

(but feeling like a badass is priceless).

📝 Journal Like a Boss 📝

Who knew journaling could be so powerful? Join our monthly guided sessions and harness the magic of group accountability. These aren’t your grandma’s diary entries—these are high-octane, wealth-building power pages. Get ready to make serious strides in your journey while bonding with your new wealth squad.

Value: $1000

Value: $3000

(but who can put a price on becoming a money maestro?)

💡 Brain Bootcamp: Big Fat Stacks Edition 💡

Value: $1000

(inner peace and piles of cash—what more could you want?)

🧘♀️ Zen and the Art of Wealth 🧘♀️

Meditation isn’t just for yogis. Each month, receive a new Money Multiplier Meditation to help you embody your Wealth Identity. These audio gems will move stuck emotions, visualize success, and connect you with your inner money maven.

🌟 Join the Wealthy Baddie Brigade 🌟

Imagine a community of powerful women all on the same mission: to build wealth and support each other. This isn’t just networking—it’s a full-on wealth-building slumber party (minus the pillow fights). Share wins, ask questions, and bask in the glow of mutual success.

Value: Priceless

(because true baddie friendships are forever).

Value: $300

(but the stress-free financial life is worth every penny).

💰 Money Management Made Sexy 💰

Get instant access to a treasure trove of courses teaching you how to manage your money like a pro. Learn to spend intentionally, systemize your finances, and pay off debt—all in just 15 minutes a month.

🌙 Rituals for Riches 🌙

Join our live monthly Money Rituals to keep your finances on track. From tracking your cash to paying down debts, these sessions are your monthly money mojo boost.

Value: $1,000

(because who doesn’t love a good ritual?)

With Cash Confident You'll Experience...

Alignment and Speed

Align your desires, goals, mindset, and actions and streamline your financial journey.

Money Miracle Grow

Use advanced mental reprogramming techniques to skyrocket your earning potential.

Community Support

Thrive in a network of the baddest of baddies who get you.

Abundance-Based Money Management

Equip yourself with practical strategies for long-term financial health.

Exponential Wealth

Open the floodgates to wealth with a powerful, reprogrammed mind.

Alignment and Speed

Align your desires, goals, mindset, and actions and streamline your financial journey.

Money Miracle Grow

Use advanced mental reprogramming techniques to skyrocket your earning potential.

Community Support

Thrive in a network of the baddest of baddies who get you.

Abundance-Based Money Management

Equip yourself with practical strategies for long-term financial health.

Exponential Wealth

Open the floodgates to wealth with a powerful, reprogrammed mind.

READY TO THRIVE PAST SIX FIGURES?

Transform your financial future with Cash Confident. Join us today and start living the abundant, fulfilling life you deserve.

READY TO THRIVE PAST SIX FIGURES?

Transform your financial future with Cash Confident. Join us today and start living the abundant, fulfilling life you deserve.

Your Journey To Financial Freedom Starts Here

Your Plan Includes:

- Welcome Training Money Multiplier Foundations . . . . Value $1,000

- Monthly Mental Methods Reprogramming . . . . . . . . . . . . Value $2,400

- Monthly Guided Journaling . . . . . . . . . . . . . . . . . . . . . . . . . . . . Value $1,000

-

Monthly Methods Coaching Call . . . . . . . . . . . . . . . . . . . . . . . Value $3,000

-

Monthly Money Multiplier Meditation . . . . . . . . . . . . . . . . . Value $1,000

- BONUS Money Management Bundle . . . . . . . . . . . . . . . . . . . Value $300

-

BONUS Monthly Money Ritual . . . . . . . . . . . . . . . . . . . . . . . . . Value $1,000

- Welcome Training Money Multiplier Foundations Value $1,000

- Monthly Mental Methods Reprogramming Value $2,400

- Monthly Guided Journaling Value $1,000

-

Monthly Methods Coaching Call Value $3,000

-

Monthly Money Multiplier Meditation Value $1,000

- BONUS Money Management Bundle Value $300

-

BONUS Monthly Money Ritual Value $1,000

Total Value: $9,700

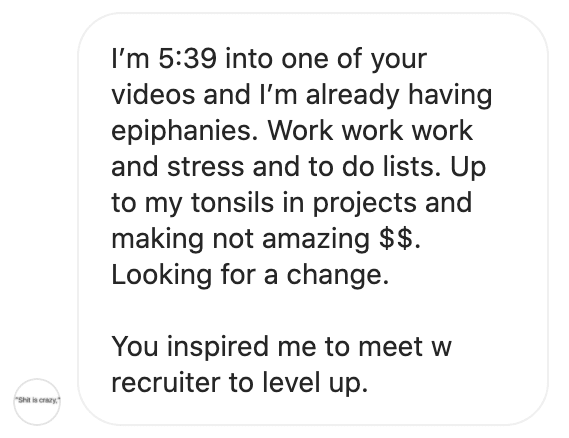

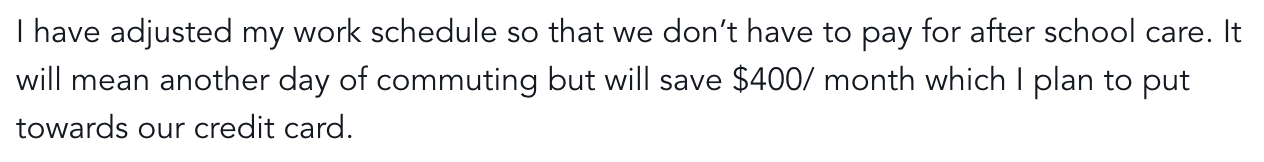

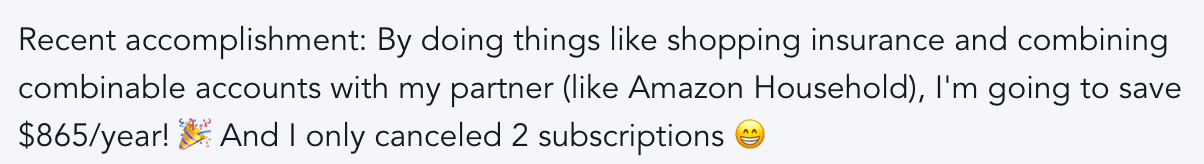

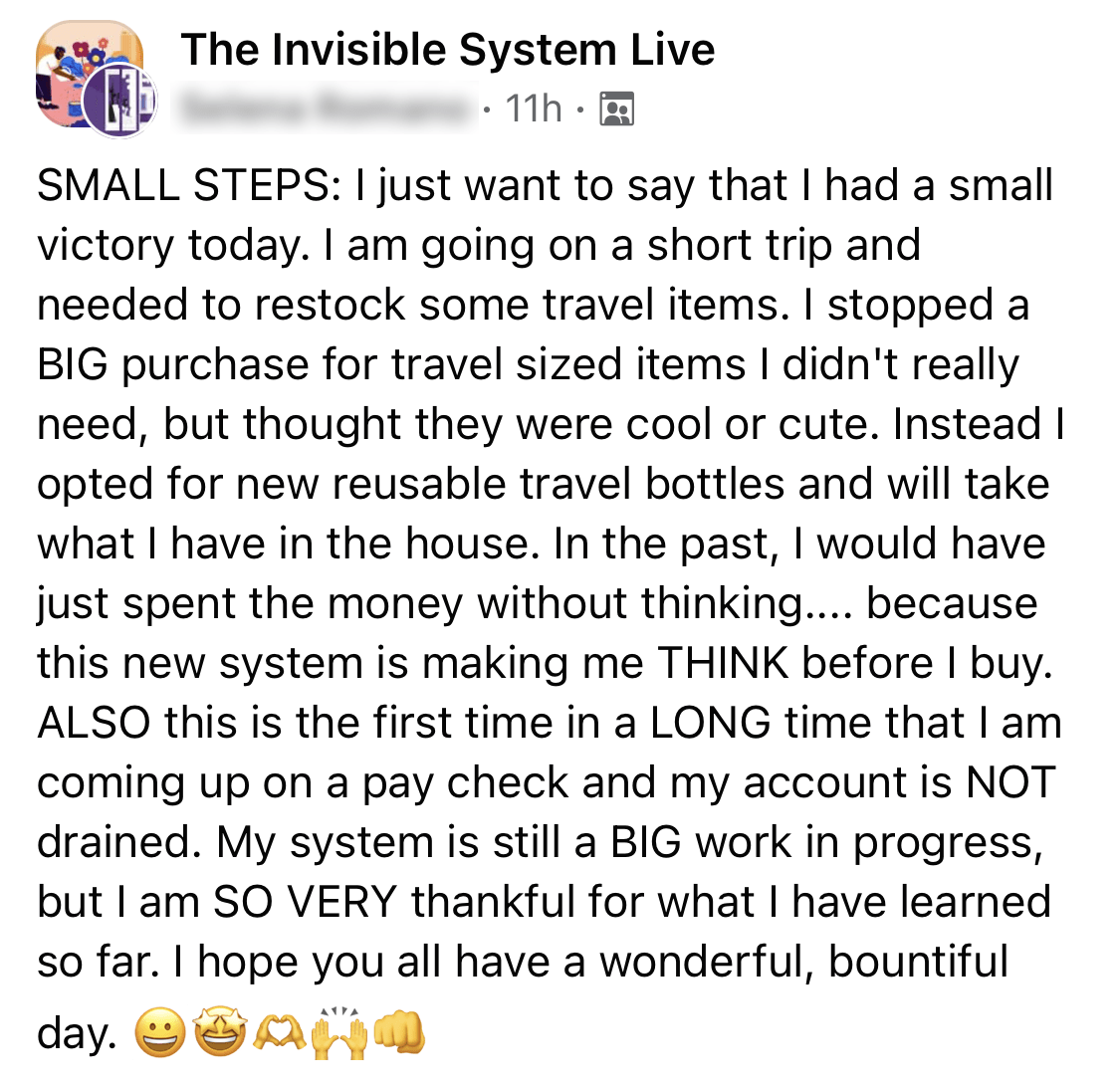

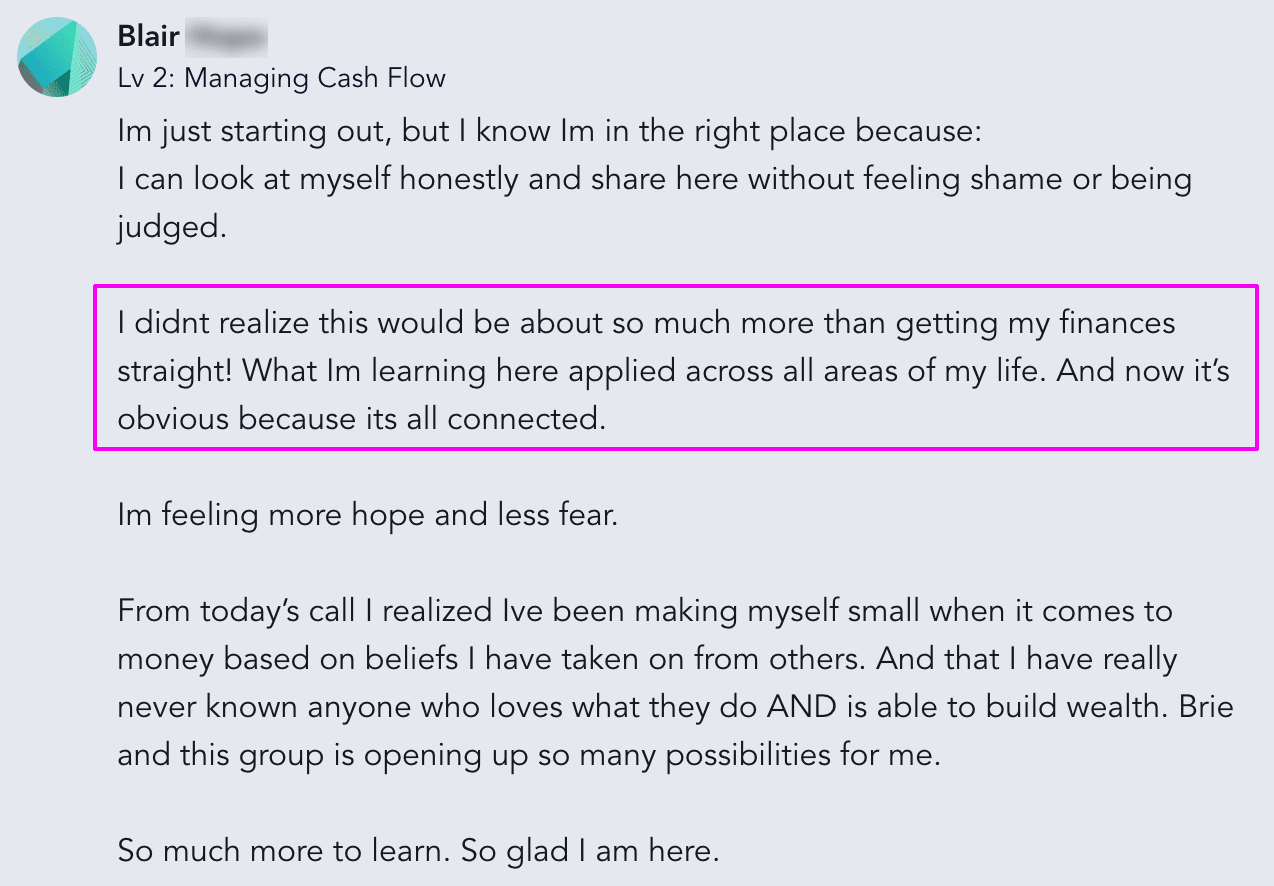

See How Members Are Crushing Their Goals

- Renata R.

- Lindee & Brandon

- Jen M.

The cash confident guarantee

Join with zero risk!

Use our powerful processes for a full 7 days and experience a profound shift in your mindset and identity towards wealth. If you don’t see rapid results, I will personally buy your membership back from you.

Members of the Cash Confident Community are rapidly creating new financial realities. Every moment you delay is a moment lost in building your legacy. The sooner you join, the more time you have to achieve your dreams and secure your financial future.

Simply email admin@cashconfident.com within 7 days for a full refund.

-OR-

Spaces are limited, and this exclusive opportunity won't last forever. Start your journey to financial freedom today, completely risk-free!

CASH CONFIDENT™ • A MONEY NAVIGATION SYSTEMS, LLC BRAND • COPYRIGHT © 2024 • ALL RIGHTS RESERVED